Senin, 22 November 2010

Euro Naik Solid oleh Keputusan Irlandia Terima Bantuan Internasional

0 komentar Diposting oleh Jalatama Artha Berjangka di 14.11| Senin, 22 November 2010 08:00 WIB |

Pada perdagangan hari ini tampak nilai tukar euro mengalami kenaikan yang cukup signifikan terhadap dolar AS (22/11). Mata uang tunggal di kawasan Eropa ini menguat setelah Irlandia memutuskan untuk menerima bantuan internasional untuk membantu penangangan krisis perbankan dan anggaran di negaranya. |

Aussie Terangkat, Investor Percaya Langkah China Tepat Untuk Hindari Bubble

0 komentar Diposting oleh Jalatama Artha Berjangka di 14.10| Senin, 22 November 2010 08:20 WIB |

Pada perdagangan hari ini tampak nilai tukar aussie terhadap dolar AS mengalami kenaikan signifikan (22/11). Aussie menguat solid terhadap rival utamanya tersebut setelah pada perdagangan akhir minggu lalu sempat mengalami tekanan jual yang cukup tajam. |

Jumat, 12 November 2010

(Vibiznews – Economy) – Pada perdagangan di pasar spot antarbank Jakarta pagi hari ini tampak nilai tukar rupiah masih melanjutkan pergerakan melemah terhadap rival utamanya, dolar AS (12/11). Di perdagangan hari Jumat ini rupiah tampak mengalami penurunan yang cukup signifikan.

Rupiah tampak sempat mengalami pergerakan menguat yang cukup solid terhadap dolar AS seiring dengan kondisi mata uang AS yang sedang terpukul. Dolar anjlok tajam terhadap rival-rival utamanya setelah Fed memutuskan untuk menyuntikkan dana senilai 600 miliar dolar untuk melakukan pembelian terhadap sekuritas milik pemerintah AS.

Akan tetapi pada hari ini tampaknya menguatnya dolar mulai memukul nilai tukar rupiah. Hari ini dolar mengalami kenaikan ke posisi tertinggi dalam enam minggu belakangan terhadap euro.

Pada akhir perdagangan di pasar spot antarbank Jakarta sore hari ini nilai tukar rupiah terpantau berada di posisi 8.919/8.929 per dolar. Posisi rupiah ini mengalami penurunan yang cukup tajam atau sebesar 23 poin dibandingkan penutupan perdagangan sebelumnya yang berada di posisi 8.894/8.904 per dolar. Rupiah telah sempat mengalami penurunan hingga ke posisi 8.923/8.933 per dolar.

Analis Vibiz Research dari Vibiz Consulting memperkirakan bahwa pergerakan rupiah masih akan ditahan untuk tidak terlalu jauh mengalami kenaikan. Rupiah akan sulit untuk menembus ke bawah 8.800 per dolar dengan kehadiran intervensi BI.

Jagung Lanjutkan Pelemahan 5 Hari Terakhir

0 komentar Diposting oleh Jalatama Artha Berjangka di 15.33Harga jagung pada perdagangan hari ini (12/11) kembali melanjutkan pelemahannya dalam 5 hari terakhir. Melemahnya pergerakan jagung untuk hari ini disebabkan oleh adanya laporan bahwa luas perkebunan produksi jagung AS yang akan dipanen untuk tahun ini diperkirakan akan mengalami kenaikan sebesar 93,055 juta hektar.

Kondisi tersebut didukung oleh adanya sentimen dari membaiknya kondisi cuaca di Memphis dan Tennessee yang merupakan 2 dari beberapa negara bagian penghasil jagung terbesar di AS

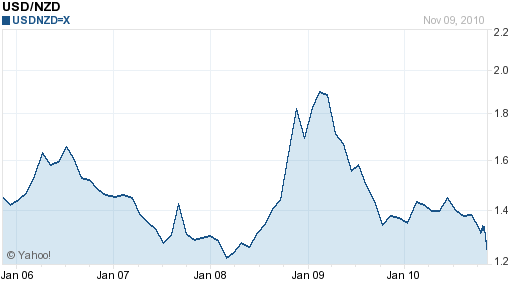

With most countries, the war cries are coming from the political establishment, who feel compelled to demonstrate to their constituents that they are diligently monitoring the currency war. This is largely the case in New Zealand, as Members of Parliament have argued forcefully in favor of intervention. Prime Minister John Key is a little more pragmatic: He “says his Government is concerned about the strength of our dollar, but is not convinced intervention would work…politicians who think intervention can happen without economic consequences, are fooling themselves.” Showing an astute understanding of economics, he pointed out that trying to limit the Kiwi’s appreciation would manifest itself in the form of higher inflation, higher interest rates, and/or reduced access to capital.